T-Mobile MONEY: Better Banking 3.1.1

Free Version

Publisher Description

T-Mobile MONEY: Better Banking - Shop, pay friends, save & earn with exclusive offers!

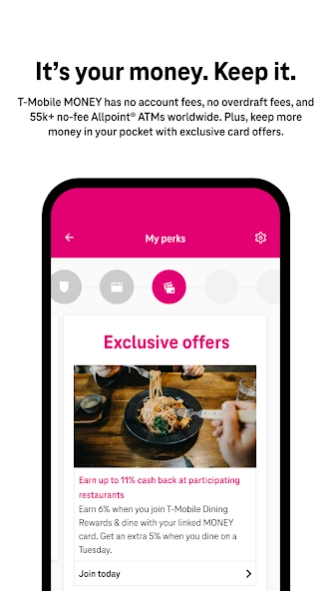

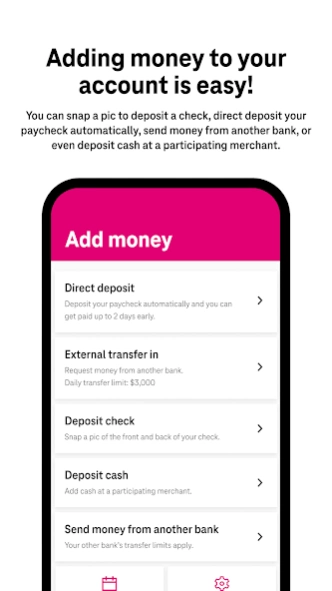

T-Mobile MONEY is the banking service that puts you & your money first! Save with no account or overdraft fees. Take your dollars further with industry-leading interest & exclusive partner offers. Get your paycheck early with direct deposit⁺, make payments without fees, & withdraw cash at 55k+ no-fee Allpoint® ATMs.^ Download the app & start banking better today!

• No credit checks. No account or overdraft fees. No minimum balances.

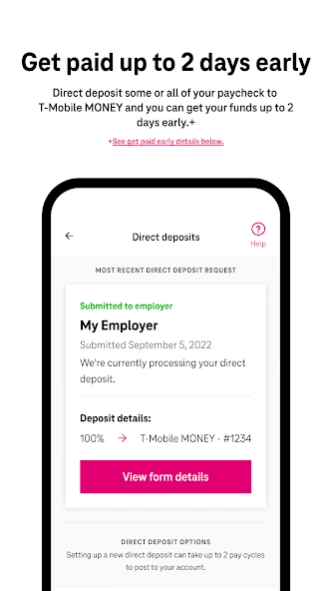

• Set up direct deposit to receive your paycheck up to 2 days sooner⁺

• Earn industry-leading interest on checking and savings balances

• Enjoy exclusive offers on dining, select travel, and more!

• Send instant payments to other MONEY customers without fees

• Withdraw cash at 55k no-fee AllPoint® ATMs^

• Make purchases with a personalized debit card, or enable Google Pay or Samsung Pay for mobile payments

• Deposit checks on your phone or add cash at select merchants (third-party fees may apply)

• Pay bills: pay by check or set up recurring transfers

• Talk to T-Mobile MONEY specialists every day of the year. Y ayuda también disponible en español.

• T-Mobile wireless customers can save $5 per eligible line with AutoPay. Plus, all payments made to T-Mobile count towards perks qualifying transactions.

T-Mobile MONEY is a banking service powered by BMTX. Accounts provided by Customers Bank, Member FDIC. All Rights Reserved.

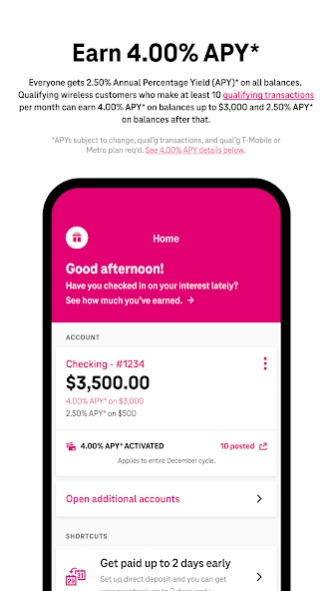

YOUR MONEY WORKS HARDER

Everyone earns 2.50% Annual Percentage Yield (APY)* on all checking and savings account balances. Plus, qualifying customers who register for perks and make at least 10 qualifying transactions per month can earn 4.00% APY* on checking account balances up to $3,000 and 2.50% APY after that.

SAFE & SECURE

Stay connected to your money with transaction and balance notifications. Easily transfer money to and from external accounts. Temporarily disable your debit card from your phone or browser if lost or stolen.

Prevent unauthorized account access with multi-factor authentication and with biometric login. Deposits are FDIC-insured up to $250,000. Plus, with Zero Liability Protection from Mastercard® you’re protected if fraud occurs.

^The location, availability, and hours of operation of Allpoint® ATMs may vary by merchant and is subject to change.

⁺Subject to description and timing of the employer payroll-based direct deposit.

*How APY works: Checking account customers earn 4.00% annual percentage yield (APY) on balances up to and including $3,000 in your Checking account per month when: 1) you are enrolled in a qualifying T-Mobile or Metro plan; 2) you have registered for perks with your T-Mobile ID; and 3) at least 10 qualifying transactions have posted to your Checking account before the last business day of the month. Qualifying transactions posting on/after the last business day of the month count toward the next month’s qualifying transactions. The first time you fund your account, as an added value, you’ll receive 4.00% APY on balances up to/including $3,000 in the statement cycle in which you make your first deposit of greater than $1, as well as in the cycle that follows that deposit provided all other requirements are met. These added value benefits are subject to change. Balances above $3,000 in the Checking account earn 2.50% APY. The APY for this tier will range from 4.00% to 3.40% depending on the balance in the account (calculation based on a $5,000 average daily balance). Customers who do not qualify for the 4.00% APY will earn 2.50% APY on all Checking account balances for any month(s) in which they don’t meet the requirements listed above. Savings/Shared Savings account customers earn 2.50% APY on all account balances per month. You must have a T-Mobile MONEY Checking account that is in good standing and funded to open any type of Savings account. APYs are accurate as of 12/01/22 but may change at any time at our discretion. Fees may reduce earnings.

For details & more on qualifying transactions, see Terms and Conditions or FAQs.

About T-Mobile MONEY: Better Banking

T-Mobile MONEY: Better Banking is a free app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops T-Mobile MONEY: Better Banking is T-Mobile USA. The latest version released by its developer is 3.1.1.

To install T-Mobile MONEY: Better Banking on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2023-10-30 and was downloaded 3 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the T-Mobile MONEY: Better Banking as malware as malware if the download link to com.tmobile.money is broken.

How to install T-Mobile MONEY: Better Banking on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the T-Mobile MONEY: Better Banking is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by T-Mobile MONEY: Better Banking will be shown. Click on Accept to continue the process.

- T-Mobile MONEY: Better Banking will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.